IFRS MASTERCLASS

- Overview

- Course Outline

- Workshop Fee & Instructions:

- Testimonials

Overview

The financial world is single-handedly governed by IFRS across the globe integrating businesses to global financial and capital markets. The knowledge, understanding and application of IFRS constitute as core competence for accounting and finance professionals. Constant revamping of IFRS by standard setters to improve financial reporting framework needs timely upgradation of knowledge and learning professionals for application and compliance.

This course is designed to provide insight to both finance and non-finance professionals over entire lot of IFRS applicable to their relevant business entities. The carefully chosen case studies, real life financial statements of top global companies and compliance requirement modelling makes this course a must for corporates.

Key Takeaways:

- Basic knowledge of the format and structure of International Financial Reporting Standards

- Application of IFRS through real-life financial statement

- The Knowledge upgrade on recent changes in IFRS

- Best case-based learning on key IFRS reporting challenges

- Transition compliance roadmap from IAS to IFRS for Financial Reporting

Course Director:

Aly Rehan Khan

Trainer| Instructional Designer| Gamification Expert

A highly profound and Expert facilitator and corporate trainer with 20+ years of experience in

designing programs, content development, facilitating organizational development workshops

in finance, design thinking, BPR, Project Management etc.

Expert in design learning using gamification, simulation and a high degree of customization. Conducting Corporate training using self designed techniques like board games, jigsaw puzzles, Wall boards, Story Boards, Behavioral Assessments etc.

Recent Engagements As Trainer & Consultant

- Saudi Aramco – KSA:Conducted Sukuk Bonds and four month “Finance for Non- Finance

Professionals” program for Saudi Aramco employees to prepare them for structural changes

emerging on account of IPO. - HSBC Middle EastCustomer Journey Mapping’ Simulation for “Emirati Development Program” and conducted online program with team simultaneously from UK, USA & UAE.

- Al-Ahsa Hospital- KSA:Served as VAT Implementation Consultant for AL-Ahsa Hospital at Hofuf KSA.

- SRACO – KSA: Served as Lead VAT Implementation project consultant for SRACO Group

Companies, one of the leading engineering and manpower supply companies in KSA. - Al-Othman Holding Company – KSA: Conducted two sessions on “VAT Implementation

Roadmap & Challenges” for 14 group companies. Further, as a consultant implemented VAT on all

group companies including Takween Advanced Industries, the sister concern of Al-Othman Group. - Emirates NBD: Finance for Bankers training by Simulating the Board game for the banking staff.

- DU Telecomm: Using Design Thinking, conducted Board Game Process Mapping for the

Finance Professionals and Business Acumen. - Ghobash Group: Training for all 6 industry sectors of Ghobash group for the Finance EVAImplementation through the Board Game Approach.

- Etjar Investments: Worked as VAT Implementation Consultant with Etjar Investments, a

a subsidiary of Mashreq Bank along with other group companies including Massar Investment.

Our Affiliations:

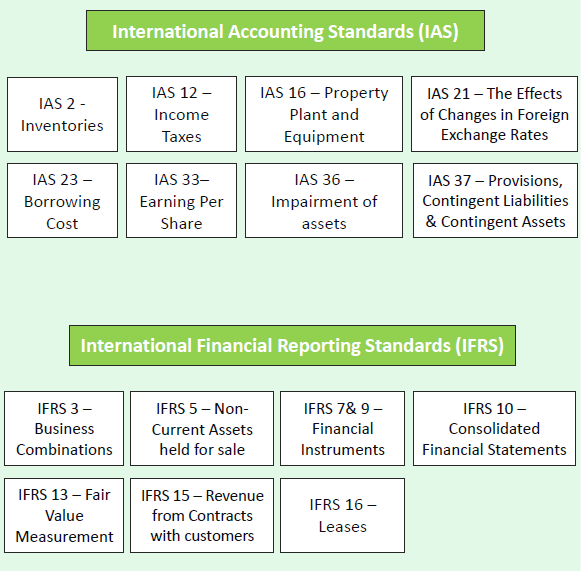

Course Outline

- Overview on Financial Reporting Standard

- Need & Application of IAS & IFRS

- From IAS to IFRS – The Transition Journey

- IFRS Reporting & Compliance Challenges

- IFRS vs. GAAP – Key Challenges

- IAS 2: Inventories

- Cost determination & Assignment Formula

- Writing down from cost to Net Realizable Value

- Cost Assignment Formula

- Reporting Requirement for Inventories

- Case Study: Managing financial challenge of cost assignment & inventory write downs using NRV in constantly challenging cost & price environment – Exxon Mobil Financial Statement.

- IAS 16: Property Plant & Equipment:

- Recognition & Capitalization of NCA

- Historical cost vs. Revaluation Model

- Derecognition & De-commissioning Cost

- Accounting for Self-Constructed Assets

- Export Documentation & Common Discrepancies

- Impairment – What, Why & When

- What is a Cash Generating Units?

- Impairment Testing Methods & Criteria

- Accounting & Reporting of Impairment

- IFRS 5: Non-Current Assets Held for Sale & Discontinued Operations:

- Transfer to held for sale – Why When and How

- Classification Criteria for Transfer

- Impairment, Measurement & Disposal Requirement

- Accounting & Reporting Requirement for IFRS 5

- Case Study: Accounting & Reporting Challenge for Non-Current Assets by top global financial Institution – The Citi Group

- IAS 23: Borrowing Cost:

- Capitalization Criteria for Borrowing Cost

- Capitalization – When Why & How

- Recognition point, deference & de-recognition

- Accounting & Reporting requirements

- Case Study: Borrowing Cost Capitalization, Deferment and Derecognition in world’s leading FMCG – Danone.

- IAS 12: Income Taxes:

- Comprehensive Balance Sheet Method of Tax

- Tax Base & Asset Base, Temporary & Permanent Differences

- Deferred Tax – Asset & Liability

- Calculation, Accounting & Reporting of Income Taxes

- Case Study: Borrowing Cost Capitalization, Deferment and Derecognition in world’s leading FMCG – Danone. Case Study: Calculation of Current & Deferred Taxes, Tax bases Assets, revenue received in advance, unrecognized items and other liabilities – IKEA Financial Statements.

- IFRS 15: Revenue from Contracts with Customers:

- Revenue Recognition – Five Steps Model Framework

- Performance Obligation & Related Revenues

- Income & Transaction Price

- Calculation, Recognition & Reporting of Revenues under IFRS 15

- Case Study: IFRS 15 complete revenue recognition model for commercial contracts – Types & Nature of Contracts, Performance Obligations – International Cricket Council (ICC)

- IFRS 10: Consolidated Financial Statements:

- Parent Subsidiary Model & Relationship

- Steps in Consolidation of Financial Statements

- Changes in Ownership & Non-Controlling Interests

- Accounting & Reporting of Consolidated Financial Statements under IFRS 10

- Case Study: Preparation of consolidated financial statement compliant with IFRS 10 – Dummy Company

- IFRS 7 & 9: Financial Instruments:

- SOFP & SOCI Disclosure Requirement

- Initial Measurement – Debt & Equity Instruments

- Risk – Quantitative & Qualitative Disclosure

- Derecognition of Financial Instruments

- Case Study: Financial Instruments disclosure, presentation & reporting – Emirates NBD Financial Statements

- IFRS 16: Lease:

- Recognition, Measurement & Reporting of Lease

- Accounting for Lessor & Lessee

- Sale & Lease Back Transactions

- Variation in Borrowing Rates & Adjustments

- Case Study: Lease disclosure, presentation & reporting as Per IFRS 16 – Toyota Motors Financial Statements

Workshop Fee & Instructions:

- 18-19 July, 2022 – 10:00 am – 03:00 pm (GST)

- Regular Fee: USD 680 Per Participant (Exclusive of VAT)

- Team Offer: Pay for 2 and register 3rd for free

- Includes: Courseware, and SIMFOTIX Certificate

- For registration (s) send us your Name, Designation, Organization, and Mobile Number to [email protected]

- For More Information please contact: Qazi Waqas Ahmed Mobile: +971 56 309 0819; Email: [email protected]

Testimonials

"It was more interactive, more concentrating on the practical side rather than theory. Good Trainer | Professional and has good communications. Trainer’s attention to detail is great | Well Managed the Training Session | Was very resourceful | Very Good, Clear and Direct instruction and focus | New knowledge. The content was extremely informative and useful. | Interactive and informative. Smart, Collaborator and can deliver the information clearly the presenter is very well educated easy to explain the subject. "

- Emirates Post Group Participants

"Excellent trainer from SIMFOTIX. | I learned a lot spend very good and it helped me. | Really professional trainer and her sessions was clear and easy and fun. | She explained everything in a easy and beautiful way. | She have good ways to conveying the information to us and we don’t feeling bored . "

- Mubadala Group , MDC BMS

"Simfotix Trainer bear a Persuasive approach in training and the company is professional in the arrangement of training till end to make it a memorable experience. The In-house session and the follow-up session is excellent approach."

- The Executive Council of Dubai

"Informative, engaging | New tools to be used for the growth for our organization | brainstorming and Good knowledge of the subject. "

- Sharjah Airport Authority

"Targeted learning should be at the top of your L&D agenda. Thank you Simfotix for being an agile partner in our learning Journey. "

- Roche Middle East

"Excellent courses delivered by SIMFOTIX to our team. Easy to understand trainer and well managed. I liked its interactive nature, and Mr Ahmed's examples of common phrases. "

- DEWA

"My team was positive and happy with the deliverables of MS Excel Training, and they think this session increased their knowledge and efficiency. "

- Ministry of Human resources & Emiratization

"Simfotix In-House training on MS Excel is well organized and our team learned lot of new things. We consider this as a value addition and meeting our objectives. "

- Road & Transport Authority Dubai RTA.

"InHouse session was best from SIMFOTIX. The trainer is excellent, and has a good knowledge on his craft. "